GST on purchases directly attributable to taxable supplies. Input Tax Not Claim ND.

Pdf Goods And Services Tax Gst A New Tax Reform In Malaysia

Yes if the purchase was made 3 months before the tourist departs from Malaysia.

. Claim for input tax. GST Tax Codes for Purchases GST code Rate Description TX 6 GST on purchases directly attributable to taxable supplies. GST code Rate Description.

Treatment of input tax attributable to exempt financial supplies as being attributable to taxable supplies. 25 rows Real Property Gain Tax Payment RPGT 5. You must use the Default report layout for your reporting codes.

List of state-level GST code. GST Tax Codes for Purchases. This article relates to the Goods Services Tax which was introduced in April 2015 but was subsequently replaced with the Sales Service Tax in September 2018.

The access to the tax code list menu is the same for both MYOB Accounting and MYOB Premier. It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018. 1 Government Tax Code.

Input Tax 6 - GST incurred and choose not to claim the input tax. GST Tax Code Table for Malaysia. This guide includes everything you need to know about digital tax laws in Malaysia whether your customers live in Kuala Lumpur or Putrajaya.

There are 23 tax codes in GST Malaysia and categories as below. Monthly Tax Deduction MTD 6. Purchases with GST incurred at 6 and directly attributable to taxable supplies.

You need to fill in the fields as shown especially the tariff code default tax rate if your products are taxable. GST is suspended on the importation of goods made by a ATS holder. Here is a list of tax codes that are.

Segala maklumat sedia ada adalah untuk rujukan sahaja. This OS-TXM is applicable for calculating the input tax recoverable ratio IRR-NTX 0. Income Tax Payment excluding instalment scheme 7.

What supplies are liable to the standard rate. GST code Rate Description. The tax codes list window displays all the GST codes available in MYOB.

Meaning of longer period. What is the GST treatment and tax code that need to be used for such supply. GST Tax Codes for Purchases.

Imports under special scheme with no GST incurred eg. GST on import of goods. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

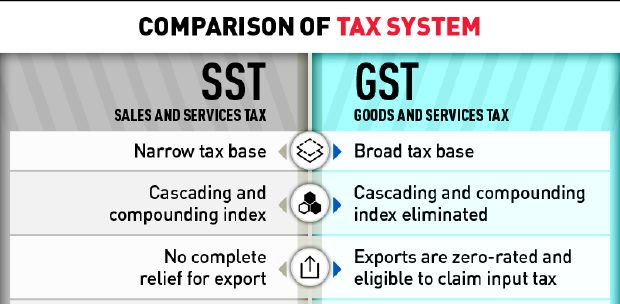

Thats what this guide is for. Charging GST at 0 the supply of goods and services if they export the goods out of Malaysia or the. Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018.

The out-of-scope supply must comply with Malaysia GST legislations to fulfil this tax code conditions. SST was officially re-introduced on 1 September 2018 replacing the former three-year-old Goods and Services Tax GST system. GST Tax Code Table for Malaysia.

GST on purchases directly attributable to taxable supplies. The Standard-Rated SR code is for. A GST registered supplier can zero-rate ie.

What is the treatment. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. If your products are non.

GST was only introduced in April 2015. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018. 10 percent for Sales Tax and 6 percent for Service Tax.

VAT in Malaysia known as Sales and Service Tax SST was introduced on September 1 2018 in order to replace GST Goods and Services Tax. The following table shows the tax code properties required to correctly generate the Malaysia tax reports provided by the International Tax Reports SuiteApp and the Malaysia tax audit files provided by the Tax Audit Files SuiteApp. To view the GST Tax Codes in MYOB open your company file then click on Lists Tax Codes as shown in the image below.

Mapping sales tax reporting codes to sales tax codes. Explanation of Government Tax Codes For Purchases. Charging GST at 0 the supply of goods and services if they export the goods out of Malaysia or the services fall within the description of international services.

Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. No specific report layout has been introduced for Malaysia GST. Attribution of input tax to taxable supplies.

What is the GST treatment and tax code that need to be used for such supply. Examples of zero-rated supply as prescribed based on tariff code in GST Zero-rated Supply Order 2014. MY country code letters followed by 15 digits.

The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. Goods Services Tax 0. The existing standard rate for GST effective from 1 April 2015 is 6.

Overview of Goods and Services Tax GST in Malaysia. Approved Trader Scheme ATMS Scheme. The code for a particular state is represented by the first two characters of a GSTIN.

Examples includes sale of air-tickets and international freight. The Goods and Services Tax Identification Number or the GSTIN is a 15-character alphanumeric identification number exclusive to each taxpayer who complies with the requirements of the GST law and registers for the tax. The fixed rate is 6 and some types of goods and services can be exempt from this tax while others are taxed at different rates.

GST should be charged at standard rate of 6 and the tax code to be used is SR 6. IM 6 GST on import of goods. For more information regarding the change and guide please refer to.

Non-applicability to certain business. Malaysia GST Reduced to Zero. Jabatan Kastam Diraja Malaysia Appendix 2 - Guide to enhance your accounting software to be GST Compliant Draft as at 13 March 2014 TX.

GST tax codes rates. Type of indirect tax. Before values can be calculated and shown on reports you must specify a relevant sales tax reporting code for each tax code that is used in the sales tax payment.

No matter where you live or where your online business is based if you have customers in Malaysia you gotta follow Malaysian GST rules. GST Tax Codes Malaysia. Sales Tax and Service Tax were implemented in Malaysia on 1 September 2018 replacing Goods and Services Tax GST.

Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. Examples of zero-rated supply as prescribed based on tariff code in GST Zero-rated Supply Order 2014. Tax Code Description GST-03 OS-TXM 0 This refers to out-of-scope supplies made outside Malaysia which will be taxable if made in Malaysia.

Supply of goods and services made in Malaysia that accounted for standard rated GST. GST has been set at zero from 1 June 2018 to be replaced by a Sales Tax on 1 September 2018. Goods Services Tax 0.

The tax code names and letters presented in the table are suggested names or. Recommended Tax Codes for Goods Services Tax. Disallowance of input tax.

Mengenal Goods And Service Tax Gst Di Indonesia

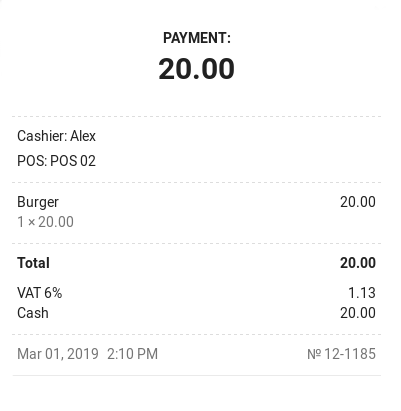

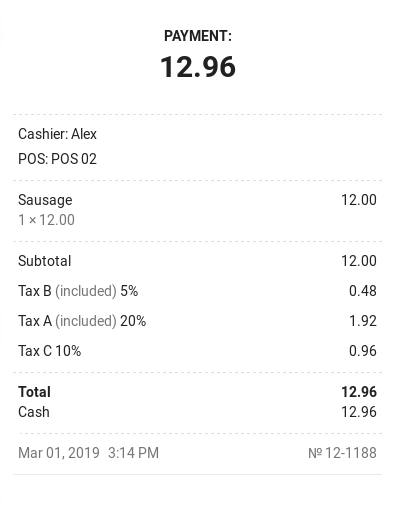

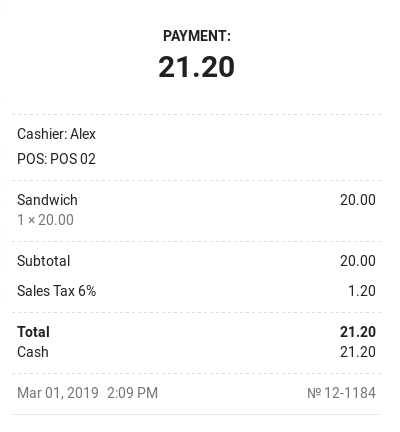

How Taxes Are Calculated Loyverse Help Center

Tax Transaction Listing Web Based Online Accounting Software Malaysia Online Accounting Software M Online Accounting Software Accounting Software Web Based

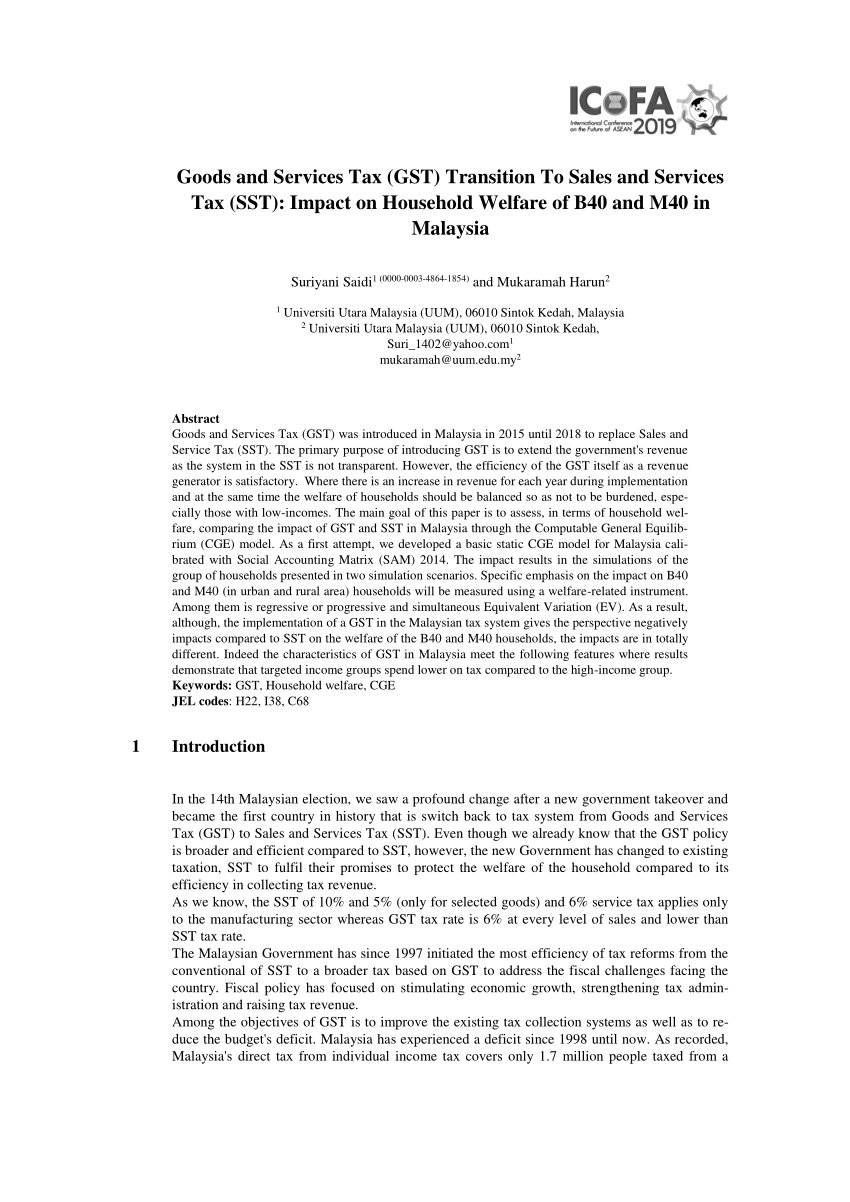

Pdf Goods And Services Tax Gst Transition To Sales And Services Tax Sst Impact On The Welfare Of B40 And M40 Households In Malaysia

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Pdf Goods And Services Tax Gst Transition To Sales And Services Tax Sst Impact On The Welfare Of B40 And M40 Households In Malaysia

The Brief History Of Gst Goods And Service Tax Goods And Services Goods And Service Tax Get Gift Cards

Goods And Services Tax Gst In Nehru Place New Delhi Id 10961834248

Gst Better Than Sst Say Experts

Gst Better Than Sst Say Experts

How A Perfect Gst Tax Invoice Should Look Like Eztax In Gst Help Invoicing Financial Accounting Tax

Implementation Of Goods And Service Tax Gst In Malaysia Yyc Goods And Services Goods And Service Tax Malaysia

How Taxes Are Calculated Loyverse Help Center

Pdf Goods And Services Tax Gst The Importance Of Comprehension Towards Achieving The Desired Awareness Among Malaysian

Apa Itu Gst Dan Apa Bedanya Dengan Ppn Simak Selengkapnya Di Sini

Pdf Public Acceptance And Compliance On Goods And Services Tax Gst Implementation A Case Study Of Malaysia

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

How Taxes Are Calculated Loyverse Help Center